direct vs indirect cash flow forecasting

As the forecast is based on predicted actuals it creates more accuracy especially in the shorter-term. Ad Download our toolkit to learn how to forecast cash flow statements even in uncertain times.

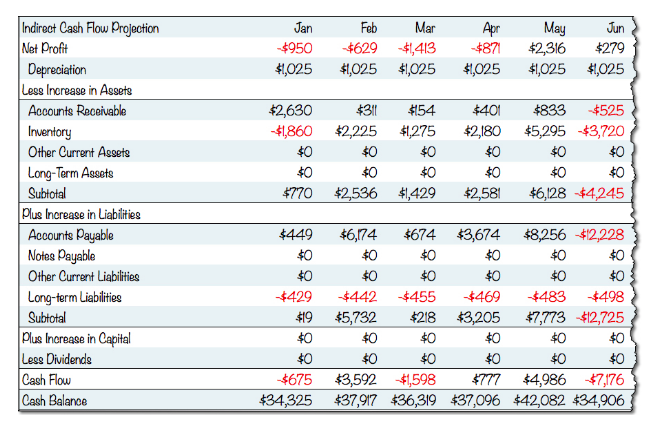

Indirect cash flow method is the type of transactions.

. You can perform a cash flow forecasting using either the direct or indirect method. This helps them to identify borrowing or investment opportunities. Two main approaches exist in constructing a statement of cash flows.

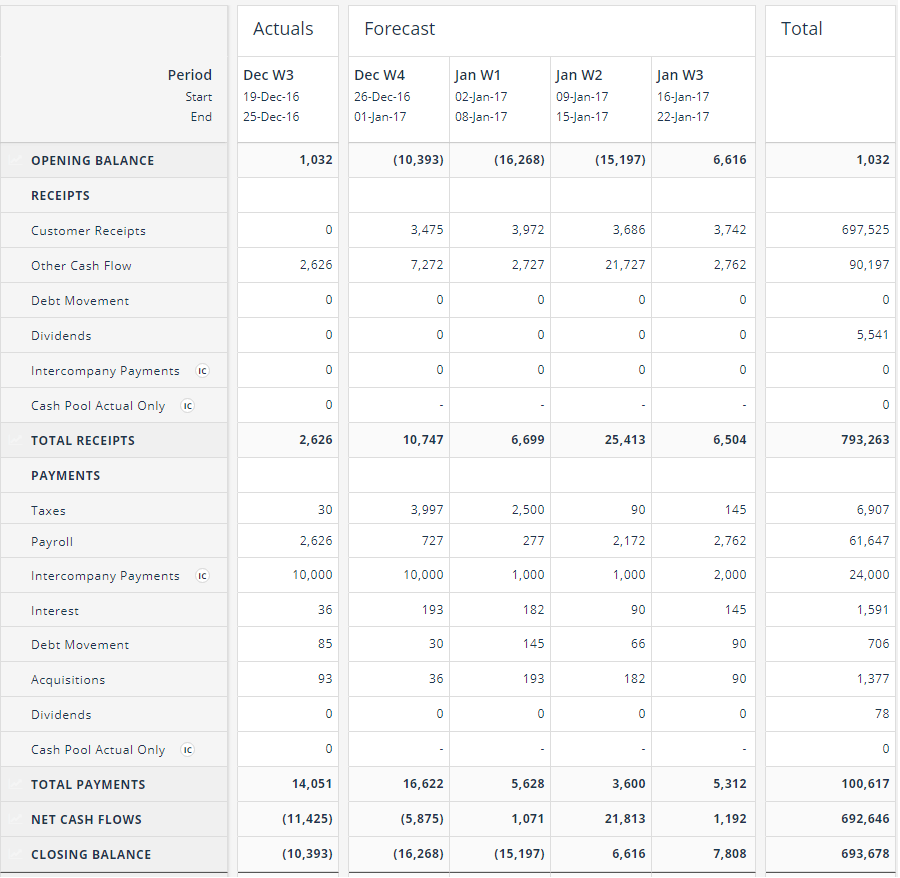

Screen grabCFO Dive. The direct method ideal for shorter periods identifies all likely future inflows and. In the case of direct cash flow methods changes in cash payments are reported in.

Ad Drive forecast accuracy and agility by connecting operational and financial models. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. Up to 5 cash back 5411 Basic Concepts of the Two Methods.

Generally speaking the indirect method is easier to use. The direct and indirect methods of cash flow forecasting affect the cash from operating activities. The direct method on the other hand describes listing all your businesss cash inflows and outflows during the defined period.

Get driver-based cash flow forecasting and scenario analysis to fit your requirements. These are called the direct and indirect method of cash flow forecasting. The indirect method is widely used by many businesses.

Forecast your future cash position and regain your control on your business finances. Direct cast flow forecasting is calculated by plugging in cash inflow and outflow directly. The direct and the indirect methods.

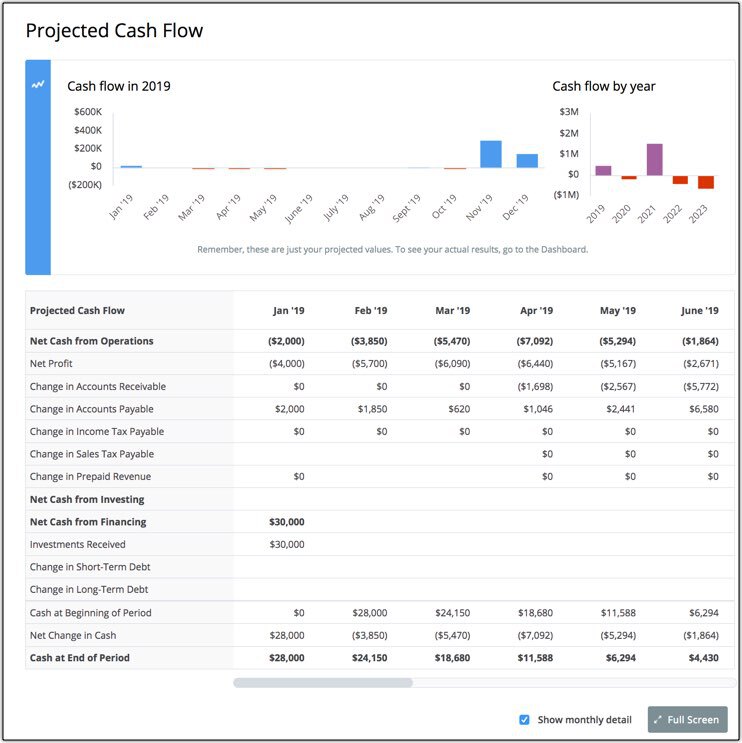

Change models on the fly. Compare multiple versions of models and what-if scenarios. Generally companies start with direct cash flow forecasting to understand their daily cash movements.

This is an essential part of measuring day-to-day cash flows and knowing. The indirect method on the other hand focuses on net income and may include cash that is not yet in the business. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

So if the direct method is so accurate why would you use the indirect method. Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative. When the indirect method of presenting a corporations cash flows from operating activities is used this section of SCF will begin with a corporations net income.

The key difference between direct and indirect cash flow method is that direct cash flow method lists all the major operating cash receipts and payments for the accounting. Change models on the fly. This then identifies your operating cash flow.

Because of the importance of an accurate cash picture CFOs and treasurers typically rely at least informally on whats known as direct cash flow. The net income is then. Whats the difference between indirect and direct cash flow forecasting.

Compare multiple versions of models and what-if scenarios. Ad Drive forecast accuracy and agility by connecting operational and financial models. Here are the key differences between direct vs.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your. The most commonly used method for cash flow forecasting is the indirect method. The direct method includes all types of transactions including credit and.

In fact its the only feasible way of. Indirect cash flow methods. One of the key differences between direct cash flow vs.

For example if a retailer sells an item on credit the indirect. Ad Optimize cash shore up your capital position extend your runway for business resilience. The main difference between the two methods relates to the cash flows from the operating activities.

It is used for long-term forecasts which range from one year to five years.

Forecasting Cash Flow Definition Example Advantages

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

The Direct And The Indirect Method For The Statement Of Cash Flows Online Accounting

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Direct Vs Indirect The Best Cash Flow Method Vena

What Is A Cash Flow Forecast The Ceo S Right Hand

Direct Vs Indirect Cash Flow Methods Top Key Differences To Learn

Cash Flows Operating Activities Direct Vs Indirect Method Accounting Financial Tax

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

How Direct Cash Flow Models Help Predict Liquidity Wsj

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal